In The Earned Life, pioneering leadership coach Marshall Goldsmith shows us how to live our own lives—not someone else’s version of them. The key to living the earned life, unbound by regret, requires our commitment to a habit of earning and connecting it to something greater than the isolated achievements of our personal ambition.

Taking inspiration from Buddhism, Goldsmith implores readers to accept impermanence and avoid the Great Western Disease of “I’ll be happy when…”. He offers practical advice for shedding the obstacles, especially our failures of imagination, that prevent us from creating our own lives. With this book as their guide, readers can close the gap between what they plan to achieve and what they actually get done.

Learn more about Marshall, one of theTop Ten Business Thinkers in the World and the top-rated executive coach.

Marshall Goldsmith’s new book offers practical advice that will help you lead a more fulfilling and satisfying life.

Get started by exploring all the free resources Marshall offers like tools, articles, podcast and videos.

This 32 Lesson online coaching features lessons based on Marshall Goldsmith’s newest book “The Earned Life: Lose Regret, Choose Fulfillment”. In this training Goldsmith offers practical advice and exercises aimed at helping you shed the obstacles, especially the failures of imagination, that prevent you from leading a fulfilling life.

The Earned Life Online Coaching program features many of the same processes that Marshall teaches his executive clients and uses in his own personal life.

In The Earned Life, pioneering leadership coach Marshall Goldsmith shows us how to live our own lives—not someone else’s version of them. The key to living the earned life, unbound by regret, requires our commitment to a habit of earning and connecting it to something greater than the isolated achievements of our personal ambition.

President of the Gasol Foundation

2x National Basketball Association world champion

5x Olympian (3 medals)

“I’ve been incredibly fortunate to have met Marshall, to have him as part of my life an to have been able to learn from him – along with learning from the many other exceptional people in his 100 coaches community. He has played a very important role in my transition from being a professional athlete to the next chapter in my life.”

Professor Harvard Business School 2021 Thinkers50 #1 Most Influential Management Thinker in with World

“The Earned Life is a great addition to Marshall’s body of work. The advice in this book can help you keep on achieving and, at the same time, do a better job of finding peace and happiness in the process.”

Marshall’s coaching invites leaders to focus relentlessly on their behavior. The leader’s behavior as well as the team’s behavior become the basis for great results and continuous improvement. This will be key to success for the connected, global, knowledge-driven companies of the future.

We were a very successful team who took our performance to the next level. With Marshall’s help we identified our two areas and went to work. We used everyone’s help and support, exceeded our improvement expectations and had fun! A team’s dedication to continuous improvement combined with Marshall’s proven process ROCKS!

You can’t teach an old dog new tricks…without Marshall Goldsmith’s help. With his coaching, you can change your old behavior to create new outcomes.”

Marshall has taught me the importance of making a positive difference in every aspect of my life. His coaching techniques and valuable lessons empower you to extract greater meaning from interpersonal relationships and provide a superior understanding of the great results that can be achieved through positive leadership.

Marshall Goldsmith is a great author and world-renowned executive coach. His contribution to our group has been immense, and we have greatly benefited from his unparalleled experience and his knowledge.

No one can match Marshall’s massive footprint in helping people become who they want to be. He is the top thought leader in executive coaching because he drives new thinking about self-motivation. The importance of self-awareness, self-engagement and positive behavioral change is best captured in Triggers. It will help light up many lives!

I have had the great fortune of working with Marshall for several years. He has helped me in so many ways. Triggers represents a natural progression in Marshall’s work and many of the ideas in it have already helped me and many of his other clients. As with all of his books, I know that Marshall’s focused, practical and insightful approach will help you in leadership, but even more important, it can help you in life!

We place a premium on developing strong leaders at McKesson and over the years we have relied greatly on Marshall’s leadership insights to support our executive talent development across the company.

CEO / one of Europe’s top electrical retailers Darty Group (France)

I had the great privilege of being coached by Marshall. He has been able to trigger change in my life and help me move to the next level in leadership. He has changed my life and career.

Marshall is a great coach and teacher. He has done a lot to help both me and our high-potential leaders. His approach is practical, useful, helpful and fun!

Professor Harvard Business School 2021 Thinkers50 #1 Most Influential Management Thinker in with World

“The Earned Life is a great addition to Marshall’s body of work. The advice in this book can help you keep on achieving and, at the same time, do a better job of finding peace and happiness in the process.”

How do we create the change we need for our organizations and for ourselves? Marshall Goldsmith is the master of helping us all find that path, avoiding the negative triggers and building upon the triggers that bring out our best.

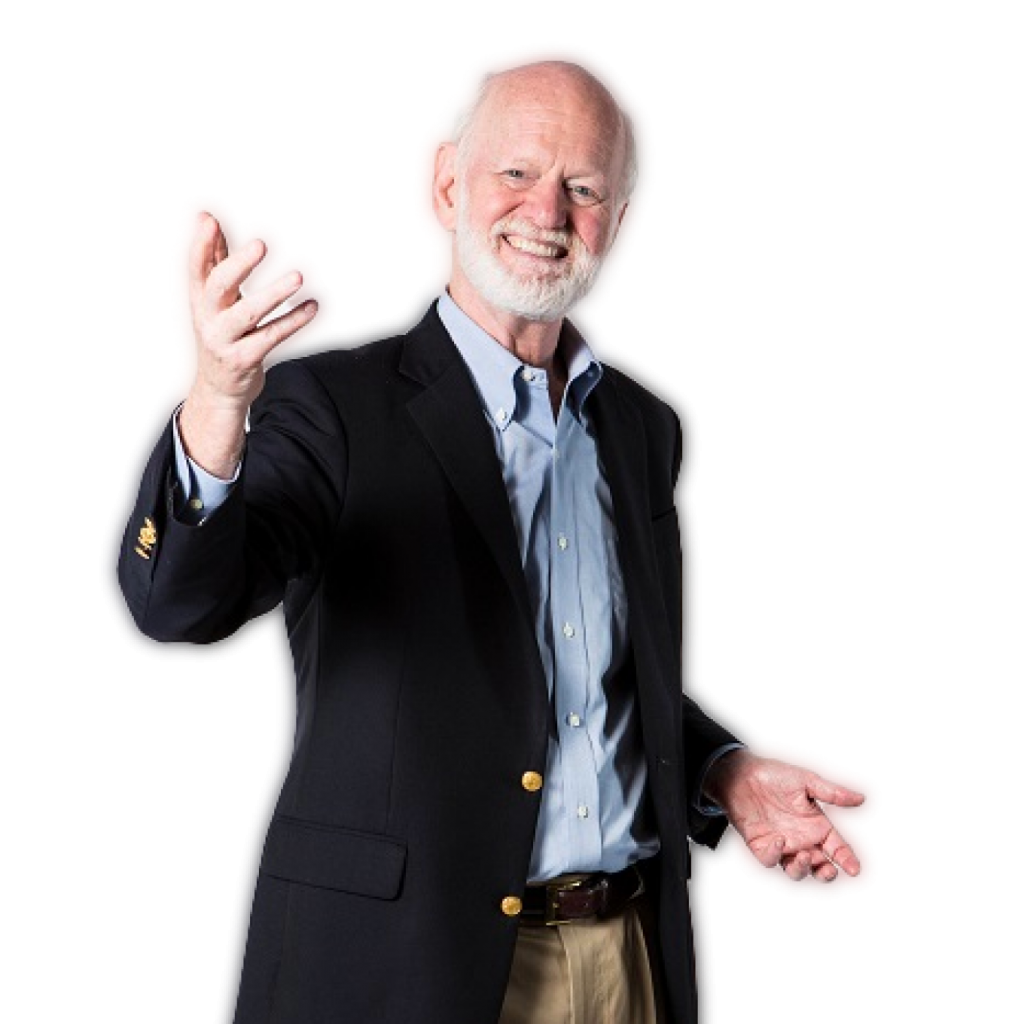

My mission is simple. I want to help successful people achieve positive, lasting change in behavior; for themselves, their people, and their teams. I want to help you make your life a little better. With four decades of experience helping top CEOs and executives overcome limiting beliefs and behaviors to achieve greater success, I don’t do this for fame and accolades. I do this because I love helping people!

As an executive educator and coach, I help people understand how our beliefs and the environments we operate in can trigger negative behaviors. Through simple and practical advice, I help people achieve and sustain positive behavioral change.

I’ve filled my website with free articles, columns, interviews, webcasts, podcasts, audios, and videos. Please read, listen to, watch, download, copy, and send these materials to anyone you think might benefit.

Even better, please share with your favorite charity, spiritual, or non-profit organization.

If you or anyone you know finds value in these resources, it will make me feel great!

Life is good.

Marshall Goldsmith

We value your privacy. We will never sell or share your personal information

My mission is simple. I want to help successful people achieve positive, lasting change and behavior; for themselves, their people, and their teams. I want to help you make your life a little better. With four decades of experience helping top CEOs and executives overcome limiting beliefs and behaviors to achieve greater success, I don’t do this for fame and accolades. I do this because I love helping people!

As an executive educator and coach, I help people understand how our beliefs and the environments we operate in can trigger negative behaviors. Through simple and practical advice, I help people achieve and sustain positive behavioral change.